Living alone in the city is becoming increasingly more expensive. Whether you are trying to make ends meet on an entry-level salary or enjoying a more established career, living solo in a major city can often be a financial strain. From sky-high rent prices to rising costs of groceries and transportation, the cost of being single in the city has risen significantly over the past few years.

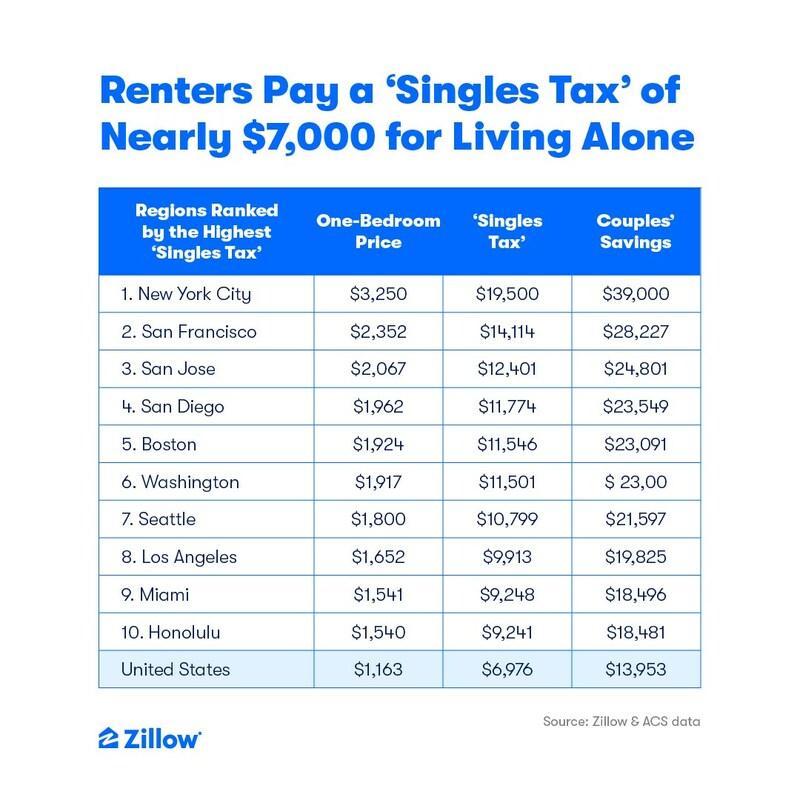

According to a Zillow report, single people in the US pay $7,000 more in rent annually in what’s known as a “singles tax.” Conversely, a couple living together can save $14,000 a year on average by splitting the rent.

The most significant expense for single urbanites is undoubtedly rent. According to recent reports, renting an apartment alone can easily take up 50% of a person’s monthly income. And that’s only if you manage to find one that meets your budget and needs. Even with roommates, it can still be difficult to afford rent in many cities due to the high demand for apartments and limited supply.

Utilities like electricity, gas, and water will also add up quickly when living alone—and each month they are often lumped together with the rent which means one huge payment at once. Some places may even require extra deposits for utilities that can add hundreds of dollars onto your bill each month.

Food and transportation costs will also take up a large portion of your budget as a single person living in the city. Groceries are not cheap these days and if you want to save money then cooking meals at home is essential (which adds time spent meal prepping plus investment in kitchen appliances). Public transportation fees such as bus/train fares or Uber rides may also start piling up depending on how frequently you use them. In some cases, investing in owning a car might be financially smart—but before making any decisions it’s best to do some research first so you know what is best suited for your situation and budget .

Living life as a single person in the city definitely comes with its own set of unique challenges—especially when it comes to finding ways to make ends meet without sacrificing much-needed time for leisure activities or personal growth opportunities. However, by managing expenses better, cutting back where necessary and saving wherever possible, it is possible to make life work from both a financial perspective and quality-of-life perspective without breaking the bank!